The greatest Boards act as aligned decision-making machines, helping the company navigate complexity. Misalignment, however, is the quickest path to dysfunction. Part 2 of this “Leading Your Board Series” explores how to create and maintain alignment across your Board.

In case you missed it:

Key Point #1: The Importance of Board Alignment

Before decisions can be made, alignment must be established. Alignment creates clarity, confidence, and trust. Without it, decisions become contentious, delayed, or ineffective.

In Part 1 of this series, we discussed how you first have to create a “team” of your Board. Teams need to have healthy conflict (not dysfunctional conflict) before they can commit (or align on decisions).

GREAT DECISIONS REQUIRE ALIGNMENT

If there is one phrase to remember from this post it’s, “Great decisions can only come after team alignment.” Even the Latin root for the word “decision” comes from “de” which means “off or away from” + caedere or “to cut/kill.” In other words, the word “decision” means to “cut away from or cut off from.” To help you remember this, “incision” means to cut into, while “decision” means to cut away from (other options).

This direction, NOT that direction. We are going down this path… not that one.

Your team, and especially your Board team must follow you as the leader down the chosen path. They won’t do that if they are not first aligned.

Other requirements for TEAM ALIGNMENT

Proper framing of the current situation, the problem, and historical facts.

Agreement on the future desired outcomes.

Benefits vs risks of the outcome or solution.

Take time to create a scorecard for the desired outcome. Define (ideally with a metric) what “great” looks like vs “good” vs “bad.” It’s amazing what a focus on a shared desired outcome and simple definitions of “great” vs “bad” can do to create quick alignment.

Alignment requires confidence of the desired future state and communicating credibility of achieving it (e.g. past performance examples, key capability gaps are identified early and often, clear strategies for closing the gaps).

Alignment is specifically NOT classic dog and pony powerpoint slides or hand waving over the real issues. Be careful of Board meetings where there are a lot of words spoken but as Shakespeare might say results of “Much ado about nothing” or “All hat no cattle”; all talk no action.

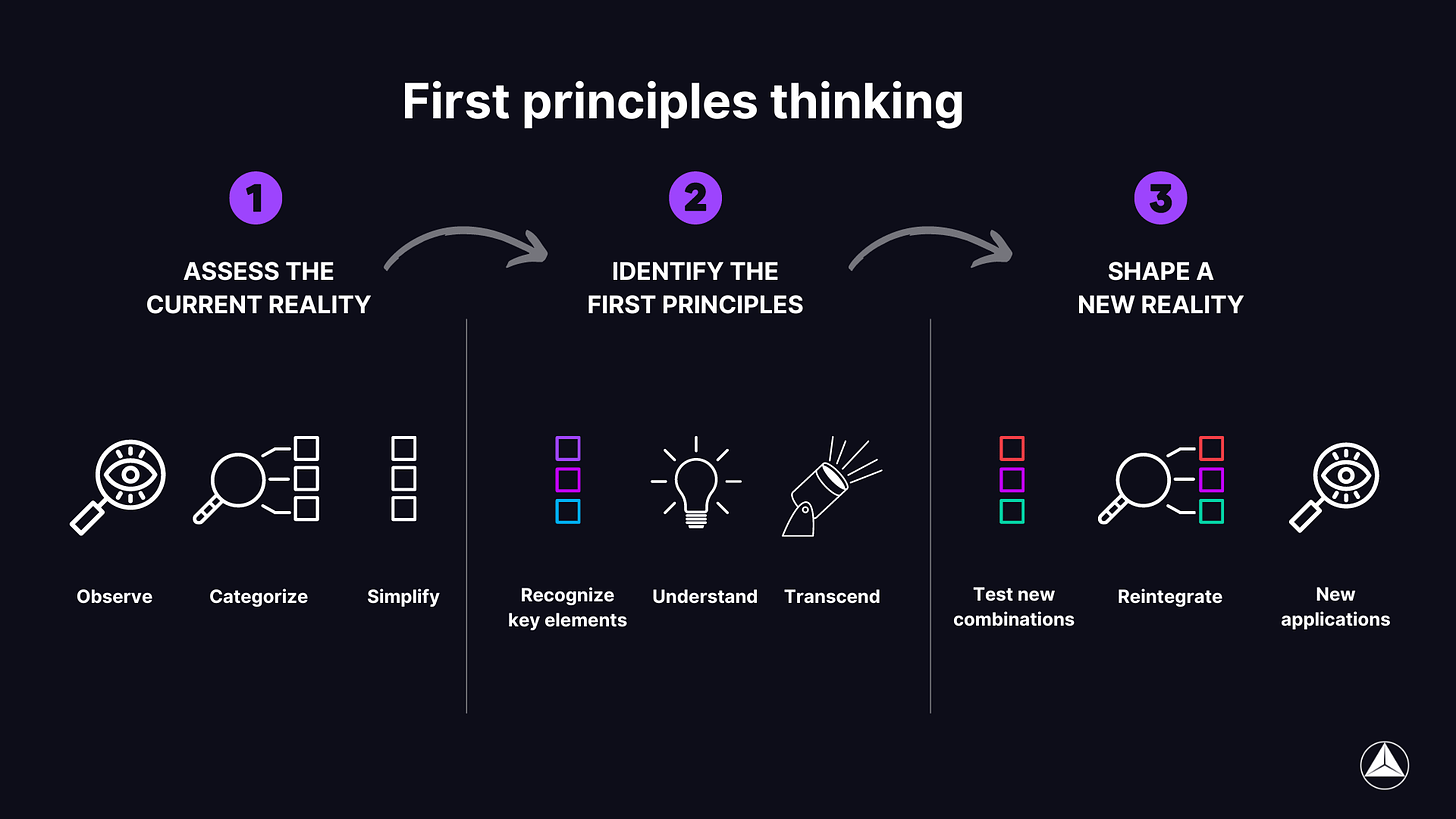

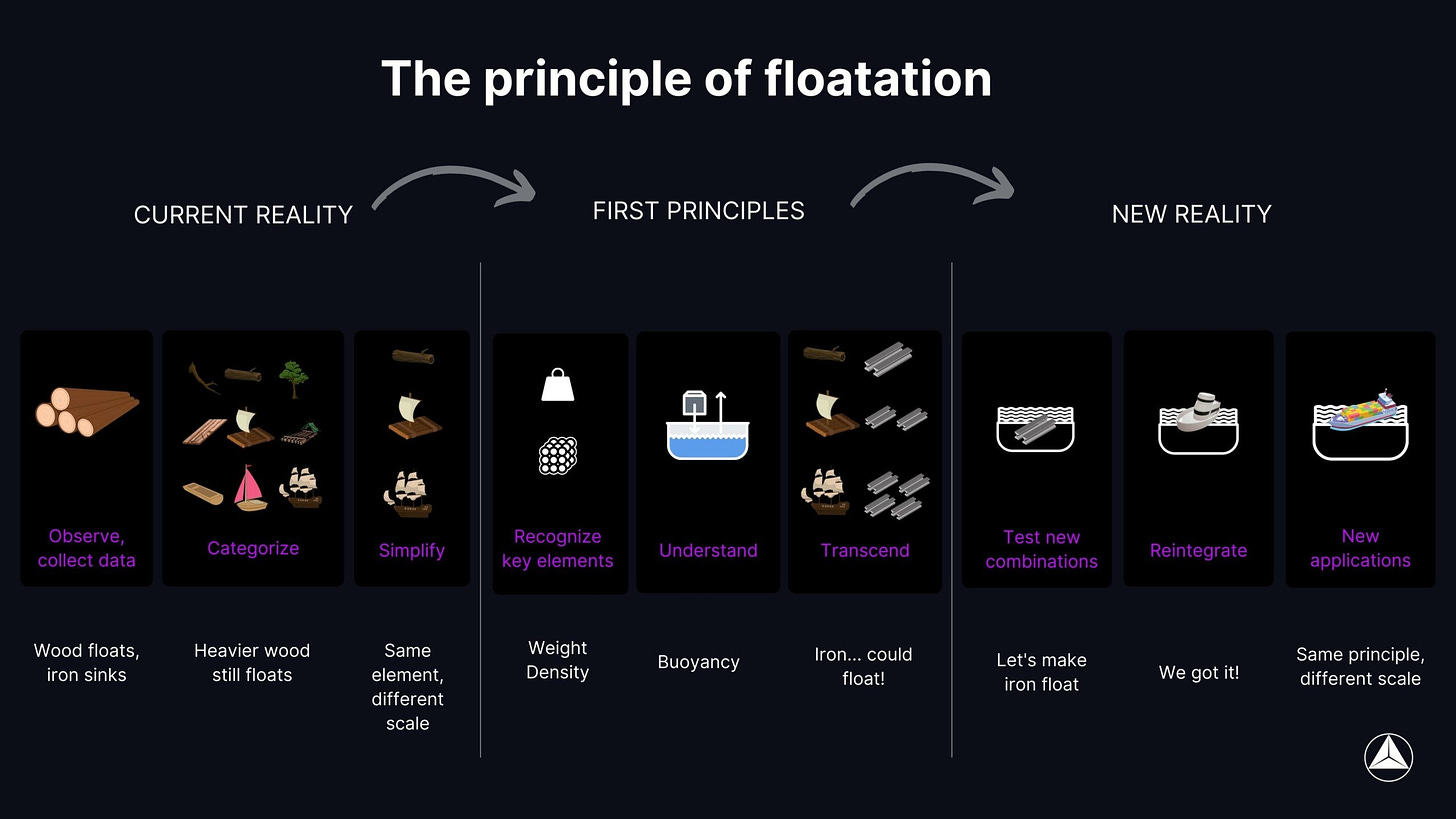

Alignment is best achieved through 1st Principle Arguments and tying back potential solution decisions to the overall company vision or values.

I wrote about Principles vs Positions earlier in 2024 in my last 3 part series on Decision Making.

P.S. - 1st Principle Thinking is specifically not THIS👇

Unfortunately, every so often you will hear such Monty Python style arguments masquerading as “1st Principle Thinking” in startup land. Be careful to not burn witches!

Key Point #2: Decision Making Frameworks for Alignment

Where We Were. Where We Are. Where We Are Going: Anchor discussions in a shared context. I recommend creating a “Tri-Box” or a “Quad Box” if necessary with each of these questions answered with 3 bullet points or less on a single Board slide.

Strategy-Structure-Execution: Link strategic goals to operational plans and resources. Here is another “Tri-Box” for a second Board slide. Don’t forget the actual slide is just the set up for the discussion. The slide itself is not the discussion!

I wrote a post that went deeper on Strategy for your future reference.

Core vs. Innovation Investments: Decide where to double down and where to pull back. I’ll be writing a post on this in the future based on proper horizon investments from a CFO’s perspective.

Building Alignment Through Communication:

In Part 1 of this series, we discussed having 1:1s with your Board members when establishing and building the Board team. It’s now time to lean on this relationship in advance of each and every Board meeting.

Your goal is to know who on the Board supports your viewpoints - and who doesn’t - before you walk into the meeting. “No surprises” is a key axiom of leadership that applies strongly here.

Don’t walk into Board meetings or Board group discussions blind; do the 1:1 work with each Board member. Make the call. Have the text conversation. Your goal here is to anticipate objections and prepare accordingly.

Use framing and context to guide discussions toward optionality and decision-making. Feel free to use my SECS talk framework for having these courageous conversations with your individual Board members and again at the actual Board meetings.

Bad Alignment Signals

Misalignment often shows up in the form of:

Lack of Listening: Boards are notorious at being bad listeners. Many are classic “1st level listeners” as they are only listening so they can rebut or say what they want to say next. Fewer are “2nd level listeners” and actually ensure they understand your point of view (or another Board members) before they provide their own. It’s the rare Board member who is an expert “3rd level listener” who has the ability to “listen to the room” and by doing so help to lead the whole room back to “1st Principle Thinking and Decision Making.”

Role Confusion: Is the Board stepping into operational territory?

Paralysis: Is the Board delaying critical decisions?

Risk Tolerance Conflicts: Are Board members aligned on how much risk the company can take?

Most Common Board Misalignment or Board Conflict Issues:

Sales and Marketing Strategy

Personality Conflicts Among Board Members or Worse - the CEO

Executive / CEO Leadership Changes

The Next Financing Round and Exit Strategies

Revenue Growth Rate; Cash Burn Multiple; vs Current Market Conditions

The VC’s Partnership/Fund Behind Your Actual VC Partner

Most Common Conflicts with Boards and CEOs:

Sales and Marketing Strategy

Personality Conflicts

Exec/CEO Leadership Changes: Hiring/Firing of an Exec Team Member

Financings, Exit Strategies, and Exit Valuation

Missing Revenue, Operating Expense, or Cash Targets

Executive Management Teams Going to the Board and Around the CEO

A Board Member’s VC Partnership (or Lack Thereof) is YOUR ISSUE and Your Potential Group Board Issue. Pick and Manage Your VC’s Carefully. Help Your Board Partner/Investor Manage Their Partnership with Respect to Your Company.

Current Market or Investor Psychology. In Just a Few Short Years We’ve Gone from “Growth at Any Cost” to “Get Profitable Now” to “Path to Profitability”.

Actionable Tips for Alignment:

Schedule annual Board retreats to focus on social alignment and strategic alignment with a goal of creating a deeper sense of the “Board Team.” In Part 1 of this series we even discussed how to structure social events and dinners. If you can’t get an annual Board retreat scheduled, try at least to invite them to any annual company all hands meetings you may have and carve out some Board specific time at those events.

Develop robust reporting dashboards to keep discussions focused on key metrics.

Create clear decision options with a well structured method to make the decision.

Emphasize transparency by sharing bad news as readily as good news.

Do you have the votes? Who on the Board agrees? Who disagrees? Create the compromise plan or choose to take a stand and to “disagree then commit.”

Summary of Actionable Frameworks for Creating Your TEAM Alignment:

Pre-Board Meeting Prep: As Dave Kellogg has historically famously stated “Never have the actual Board meeting at the Board meeting.” Tap your interpersonal capital to engage each Board member 1:1 prior to each meeting to focus on alignment and potential concerns in advance.

Switch Seats and Speak Their Language: View your presentation from each Board members’ perspective - what do they care about, and why? Their biases will be reinforced by their own network (social capital) as well as their respective intellectual capital.

Always Lead with Why: Help the Board understand not just what you’re doing but the ”Why” behind every decision. Not just the “Why” but even more importantly is “Why now?” and “Why this is critical.”

Conclusion:

Alignment doesn’t just happen; it requires focus, intentionality, preparation, and trust. By prioritizing alignment, you can unlock the Board’s potential as a true strategic team.