It’s Agile Financial Planning Time… It’s NOT Annual Financial Planning Time

Why Annual Financial Plans Should RIP in Agile Startups

Did you know…

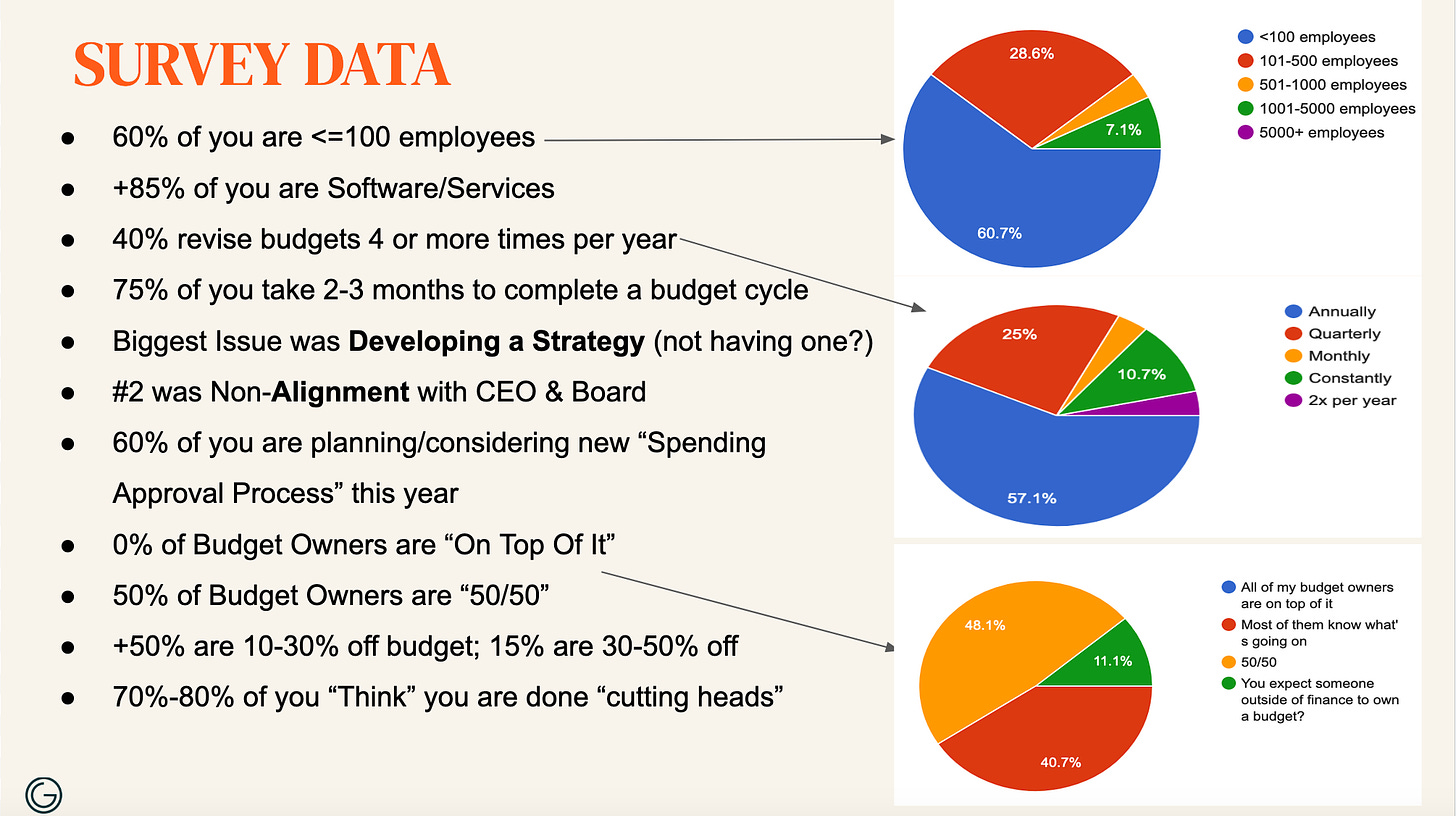

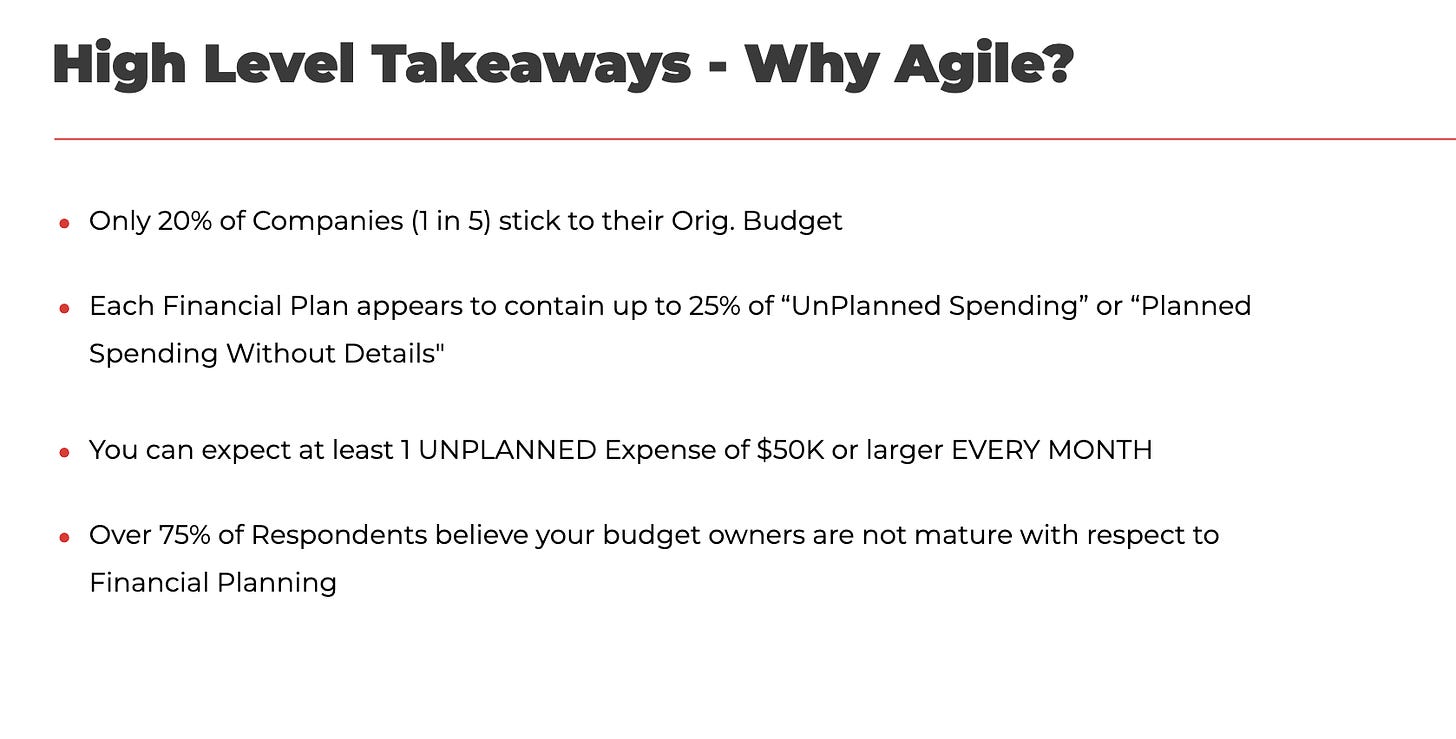

Over 80% of financial leaders in venture-backed startups re-plan with their Boards more than 3 times a year? In contrast, less than 20% of startups stick to a single additional re-plan after the initial Board plan. The vast majority are recalibrating their financial strategy on average every quarter. [1]

We are now in the era of Agile Planning. We should bury the traditional “Annual Plan” as a relic that no longer fits the dynamic nature of most high-growth startups.

Agile practices have already transformed engineering and GTM teams - so why do so many financial leaders and venture backed Boards still cling to the rigidity of an annual financial plan?

Your financials after all are simply a reflection of the underlying operations, shifting activities, and shifting strategies of your business - especially those engineering and sales and marketing activities.

If everything else is moving fast and adapting, your financial plans must follow suit.

The Shift to Agile Financial Planning

In groups like the Operators Guild, Founders Circle Capital, and Board rooms across Silicon Valley, Agile Financial Planning is becoming the new standard.

In fact, public companies have been doing Agile Financial Planning for years - they just don’t call it that. Instead they call it “Revised Financial Guidance” in their quarterly conference calls. Yes, they are revising their financial “plans” the same 3-4 times per year!

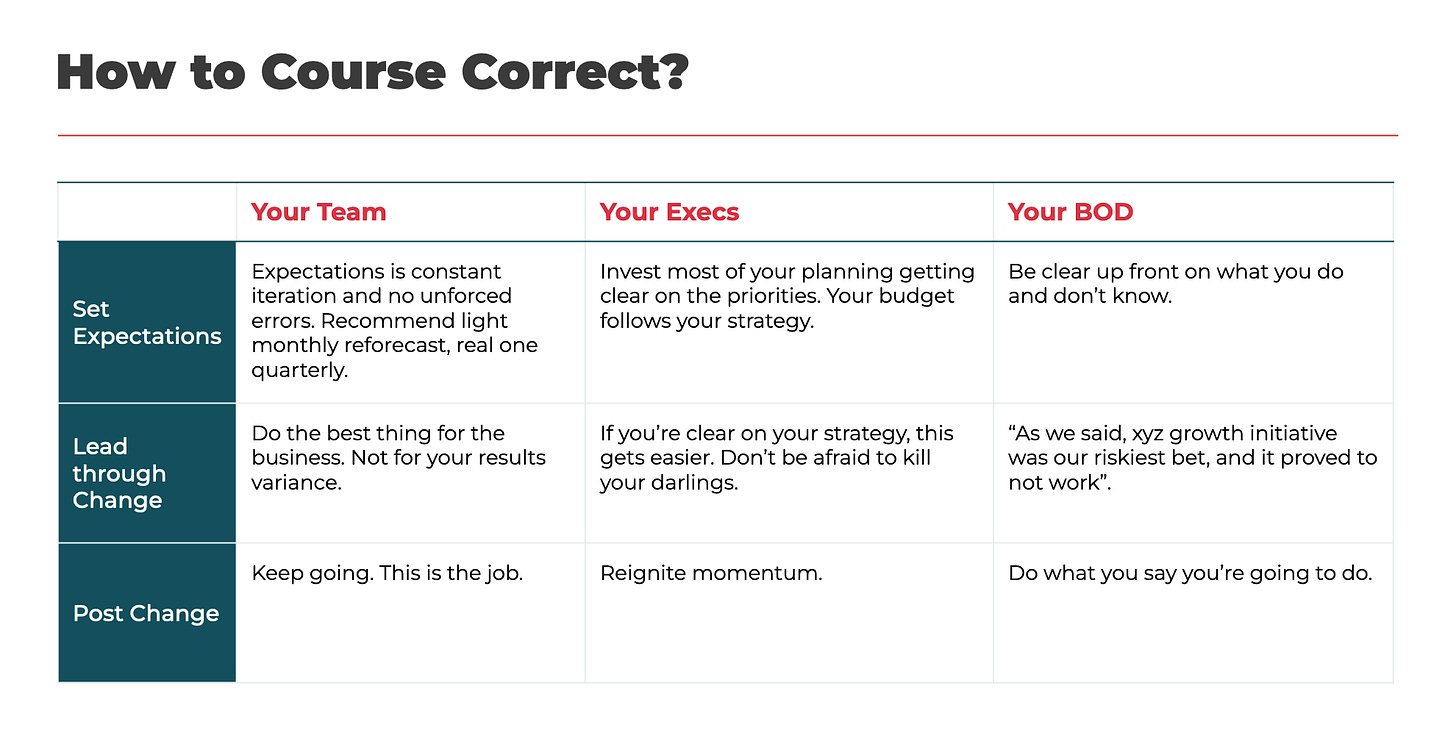

Agile Planning sets the stage for financial leaders to go from back room reporters to the strategic financial partners. By adapting quickly to market changes, course correcting headcount growth, and aligning all other spending to revenue growth, the financial leader will find their hands on the financial wheel vs simply braking or accelerating while somebody else is driving.

Key Concepts for Agile Financial Leaders

To help your company transition to Agile Financial Planning, think of your role as the Chief Alignment Officer - I’ve spoken of this title I made up in previous posts. In Agile Planning, you are really only aligning a few critical areas:

1. Revenue Growth vs. Expense Growth

How confident are you, your exec team, and your Board in your revenue projections? Contrast that with your significant confidence in your fixed operating expenses. In venture backed startups, typically 70-80% of all operating expenses are fixed and tied to headcount/people. Once you hire, you’re locked into those expenses, so make sure you put a governor on that headcount accelerator pedal.

Tip: Align with your People/Recruiting team to strategize on how to put better hiring practices and processes in place to tie a new offer letter to new revenue contracts.

2. Hiring Plan - Headcount Growth

Every position in the company needs to have clear activity and capacity metrics. If you don’t have them right now, it’s time to go on a “Listening Tour” (upcoming post) to document headcount activities in terms of clear metrics.

3. Cash Balances and Months of Cash Runway

Whatever financial plans are developed and operated to, the most critical guardrail for your planning is your forecasted cash balance and months of cash runway at various points in the planned future. “Mind the Gap” between your forecasted Revenue and your Fixed Operating Expenses (Headcount Hiring). Falling through this proverbial gap is the most common way for companies to hit the third rail of financial shock.

Ask More Powerful Questions:

Which positions are currently capability-constrained?

Do we have certain “tour of duty” roles?

Which new headcount positions are tied to customer growth (new customer contracts won)?

Which positions are linked to customer retention?

These kinds of questions coming from the Chief Alignment Officer - I mean Financial Leader (CFO, VP Finance, etc.) - are very powerful. Start asking more powerful questions (oh, there’s another future post! There’s so much to say - and only a short weekly newsletter of space!).

The “Buckets of Money” Approach

A simple analogy is to imagine your operating expenses as 100 $1 bills. How will you allocate them? Customer growth gets how many $1 bills? Shouldn’t we spend more in customer retention? Wait, we need to plant some more seeds in R&D and innovation. Those seeds cost more $1 bills.

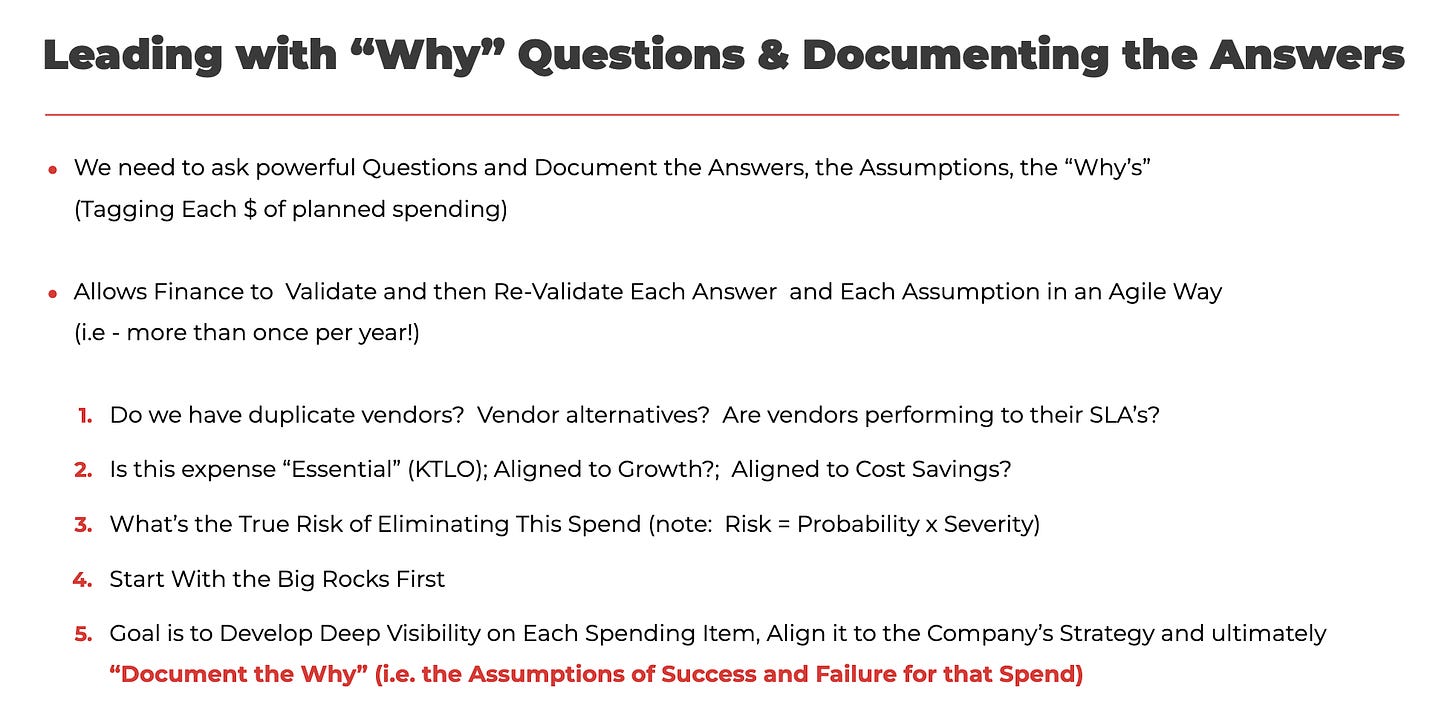

Agile Financial Planning is about asking the right questions, documenting answers, continuously revisiting assumptions, and then course-correcting your upcoming financial plans. Set-It-and-Forget-It Annual Plans should be a thing of the past.

Start by asking more powerful questions:

1. How Agile Can We Afford to Be?

Work with your Board to establish top-level financial guidance. Define maximum cash burn and ensure you’re aligning revenue forecasts with fixed expenses.

2. What’s the Activity Metric for Each Position?

Every role needs a clear metric, even in non-sales positions. Whether it’s collections per month or invoices processed, define these with your department leaders and document them.

3. What’s the Capacity Metric for Each Position?

For each role, establish productivity/capacity ranges for that position. At what point do you need to hire more? What’s the burnout rate? If one product designer can handle 8 engineers, decide when you’ll need to hire the next one.

Note: In the above example, by definition “position capacity” will change quarter to quarter as you hire your 2nd product designer after you hire your 9th or 10th engineer. Make sure to “fill this capacity bucket” before hiring your 3rd product designer.

4. Continuously Challenge All Capacity/Productivity Metrics (Every 6 Months at a Minimum):

Example: Is there a software system or other type of AI automation we can use to increase the capacity/productivity of this position? Don’t ever settle for status quo.

Powerful Question: How many “Humans in the Loop” do we really need for each role?

IMPLEMENTING AGILE PLANNING: Steps to Consider

Define the WHO (requested headcount) into key “WHY Buckets”

KTLO (Keep the Lights On positions); or KTCO positions? (Keep the Company Operating < at bare minimum level)

Customer Growth (positions required only when new revenue contracts are signed)

Customer Retention (retaining customers and renewing their customer contract and hopefully expansion $)

Innovation (new features and new product development)

Hint: Use additional powerful questions here such as “If you can only afford 1 new hire in your department, who would it be and why?” Or “Is there anyone in your department that if they were hit by a bus, it would put the department/company at risk?”

Agree on WHEN to Hire New Headcount and Document the WHYs

If it’s in the Customer Growth Bucket - it’s likely slightly in advance of the New Customer/Revenue. Agree and define this time frame with your people/recruiting team.

If it’s Customer Retention Bucket - the hire should only happen based on headcount metrics to properly support that customer.

KTLO/KTCO needs to be hired now since not hiring puts company at risk in these critical company functions of keeping the lights on and the company operating without things breaking.

Innovation/Product Development should have it’s own proper “Envelope of Spending” since “too much innovation” is just as bad as “too little.” There is a proper balance of innovation spending - likely represented as a % of Revenue.

Continuously Communicate at All Levels of the Company (7 Times and 7 Different Ways) the Following:

Established Board guidance: (the answers to the question of “How agile can we afford to be?” State this guidance in terms of required Revenue Growth, Cash Balance/Months of Runway, and Total Fixed Operating Expenses which are your guardrails.

Communicate the need to always align revenue forecast confidence with fixed OpEx spending (headcount):

Lead with - “If we beat our Revenue Forecasts, we should be willing to spend more.”

“If we miss our revenue targets, we should delay spending and delay hiring.”

Use the “Envelope Analogy” (e.g. We only have 100 $1 bills to spend and have to allocate a certain number to each leader).

Ask the Leadership Team, Board, and CEO the following questions at least every quarter:

What bets or risks are we willing to take to stray from our top level financial philosophy and current financial guidance?

Are we solving for Speed or Quality/Accuracy with our financial decisions? Financial “Speed” and financial “Accuracy/Quality” are usually at opposite ends of the Agile Planning spectrum. Speak this truth. Somebody needs to say it and ensure everyone around the table understands the decisions and opportunities and risks being taken.

What’s the true company cost of going slower? Can we afford to go a little slower and emphasize Product Quality or Financial Accuracy of our Cash Burn and/or Months of Cash Runway over “Operational Speed” (going fast and figuring it out later)?

Document All Answers to All Questions on Financial Philosophy; Activity Metrics by Role; Risks/Bets in a Shared Doc

The thinking of the company will change over time and the “What Were We Thinking Before?” will not only inform what we are thinking today but it will hold everyone accountable to better decisions in the future.

These documented assumptions will also be invaluable for all future decision making allowing everyone (esp. the CFO) to challenge changing assumptions.

When you find yourself with incomplete or unsure “Data” then make an assumption (gut) and by documenting and tracking the “gut assumption,” the actual activity turns into data quite quickly… thus turning opinions into data for future decision making.

Rinse/Repeat Steps 1-4 Every 6 Months OR Earlier if/when your agile venture-backed startup strategy changes or a new competitive threat arises.

Creating a Culture of Agile Planning

Ultimately, your goal is to build an Agile Financial Planning culture across the entire organization and teach your leaders how and when to make financial trade-offs.

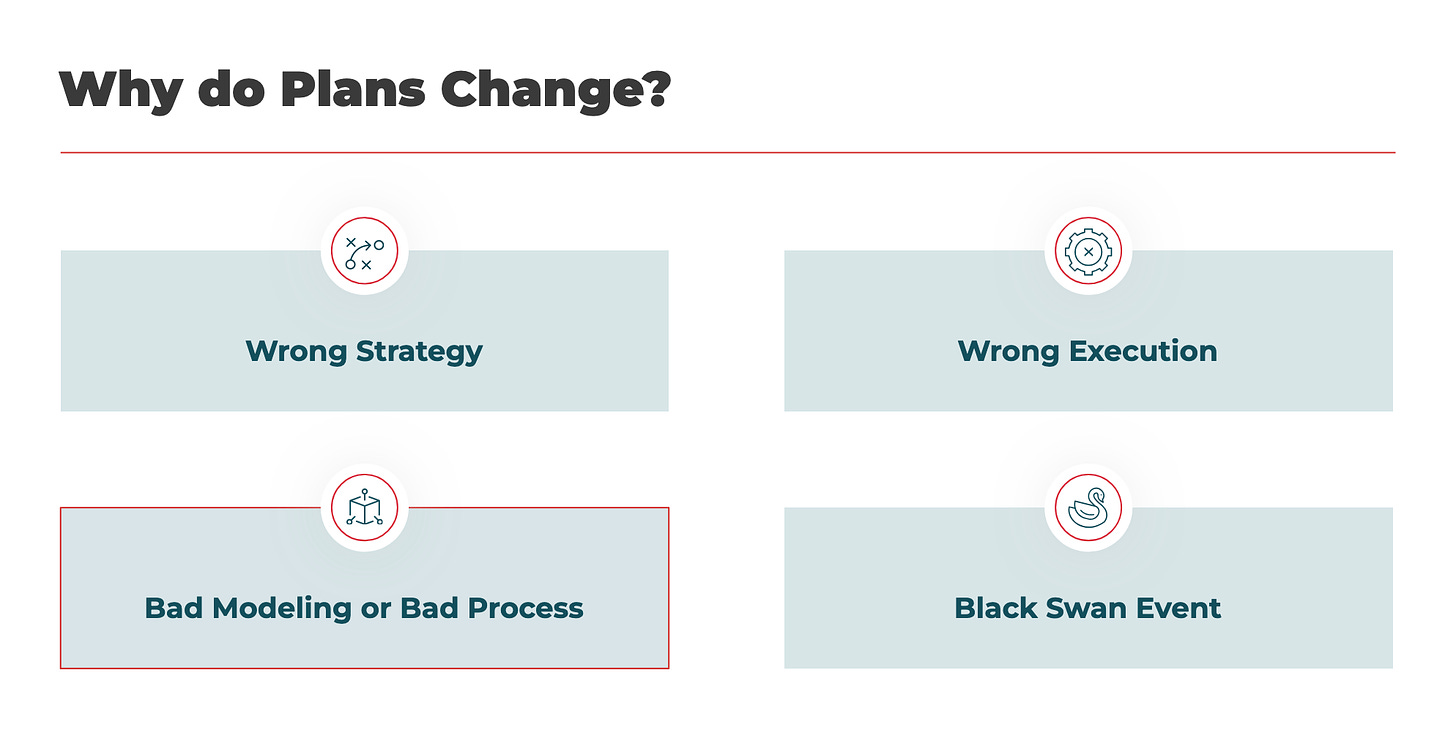

A “Revised Plan” - just like public company’s “Revised Guidance” is nearly always the result of Revenue being either higher or lower than expected and/or a major shift in your industry or a competitive threat your company didn’t see coming.

Imagine what happened inside executive teams and board rooms when ChatGPT launched seemingly out of the blue in November 2022?

Encourage open discussions with leadership and the Board about risks and trade-offs of various strategic scenario’s encapsulating “Where You’ve Been,” “Where You Currently Are,” and “Where You Need To Go.” It’s not just about the dollars; it’s about properly aligning an agile company strategy with similar financial timing, financial quality, and financial agile planning speed.

Final Thoughts:

The days of the annual budget and an annual headcount plan are over. It’s time to embrace the flexibility of agile financial planning. Be nimble and re-plan when required, ensure your team understands the metrics that matter for each position, and partner with each executive leader and your individual board members to make sure everyone understands and gets aligned around the proper future trade-offs to enable the financials to stay on course.

MORE

CJ Gustafson, CFO, writes annually about how to annually plan. A few weeks ago he did a podcast - “A Masterclass in Annual Planning”

And also on his blog: “Your Definitive Guide To Annual Planning”